Buying a home is one of the biggest steps in life, and it usually comes with a big loan called a mortgage. The mortgage you choose will affect how much you pay every month and how much you will pay back over many years. Most people start by going straight to their bank for a home loan. But here is the secret: sometimes, mortgage brokers can get you better rates and deals than banks ever show you.

In this blog, we will break down how the best mortgage brokers work, why they can often secure lower mortgage rates, and why it might be smart to use one when buying your dream home.

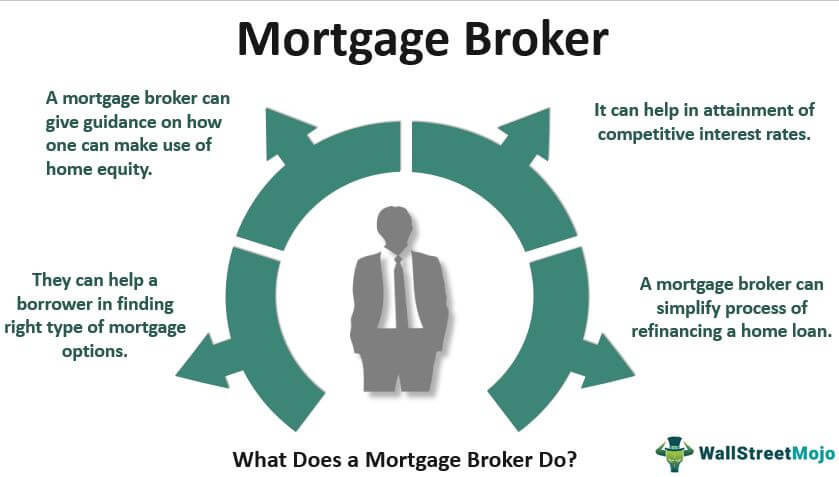

What Is a Mortgage Broker?

A mortgage broker is like your personal guide to finding the best loan. They do not lend you the money themselves. Instead, they work with many lenders, banks, credit unions, and private lenders to match you with the loan that fits your needs.

Think of it this way: if buying a house is like taking a trip, a bank shows you only one road, their road. A mortgage broker, on the other hand, knows all the roads and shortcuts. They will help you pick the fastest and cheapest route to get your mortgage.

Why Don’t Banks Always Give the Best Rates?

Banks have their own home loan products, and those are the only ones they will show you. Banks are not as competitive as other lenders are, although they are trying their best to remain competitive.

Additionally, banks incur extra expenses to pay, such as personnel, branches, and overheads, which may render their rates less favourable. Banks are also likely to be strict in lending.

So, if your credit score is not perfect or your income is a little unusual (like if you are self-employed), you may not get the lowest rates, or you might even get turned down.

How Mortgage Brokers Can Get Better Rates

1. Access to Many Lenders

Mortgage brokers work with a wide network of lenders. Because they send so many applications each month, lenders often reward brokers with special deals or discounted rates.

2. Lower Costs

Brokers do not run big branches with lots of staff like banks do. Their lower costs often mean better rates or reduced fees for you.

3. Wholesale Rates

Some lenders give brokers access to “wholesale rates.” These are lower than the retail rates banks usually offer directly to customers. Brokers can pass these savings on to you.

4. Personalized Fit for Your Circumstances

Everyone’s financial situation is unique. Brokers understand which lenders are more willing to be flexible with credit scores, special income circumstances, or special circumstances. That means they can identify the lender that is most likely to provide you with the best rate.

5. Negotiating Power

Brokers are well placed to bargain since they take lenders to a stream of customers that are available at any given time. They are able to get reduced interest rates, reduced charges, or even other perks that you may not attain independently.

Benefits Beyond Just Lower Rates

Being represented by a mortgage broker is more than saving interest. Here are additional benefits you will receive:

- Time Saved: You do not have to go to several banks. Brokers shop for you.

- Convenience: They sort through the confusing documents and lay things out in simple terms.

- Increased Loan Options: Rather than a single bank’s terms, you will receive many offers.

- Quicker Approvals: Brokers are perfectly aware of what lenders require, which quickens the process.

- Assistance on Fees: Most brokers can negotiate some fees downward or away, saving you cash at closing.

Is a Broker Always Better Than a Bank?

Not always. Some banks may run special promotions or give loyal customers lower rates. Plus, a few brokers charge fees for their service. That is why it is important to compare.

The most intelligent thing is to review your bank’s deal, then consult with a few brokers. Comparing the two makes sure you do not get left behind on the best offer.

How to Select the Best Mortgage Broker

Not all brokers are created equal. Follow these guidelines to select the one who suits you:

- Check Experience: How many years have they been working?

- Read Reviews: Check what previous customers have to say.

- Ask About Their Lender Network: A good broker works with lots of lenders, not just a handful.

- Understand Their Fees: Know how they get paid by you, the lender, or both.

- Trust Your Gut: Choose someone who listens to your needs and explains clearly.

Real Example: A Broker Securing a Better Rate

Let us consider Jane, for instance. She has a median credit score. Her bank is willing to lend her a mortgage at 7% interest. Alternatively, she speaks with a mortgage broker who makes her applications with multiple lenders. One of the private lenders accepts her at 6.5% and waives some fees. In the long run, Jane has saved thousands of dollars and purchased her house earlier.

Conclusion

Selecting the correct mortgage is no trivial matter, and the best mortgage rates are not always from banks but from mortgage brokers. Brokers have more lenders to choose from, lower fees, wholesale rates, and excellent bargaining power. And they save you time, stress, and money.

If you are going to purchase a home, do not settle for your bank’s rate. Call a mortgage broker as well. They compare both to find the best way to protect your money and future.

Keep in mind: it is not only about obtaining a loan, but also about obtaining the correct loan. And the correct decision today can save you thousands tomorrow.