What can be some of those financial lessons that held up your curiosity, which you wished you learned at school?

Well, many a time, people face acute difficulties for getting on the original financial situations that may arise due to insufficient knowledge and experience. Knowing about the financial skills and money building tricks from an early age can be an excellent idea for getting on your toes for further worldly problems. Needless to say, you may have noticed some of the financial blogs and articles to be written by people who are already in a financial mess! That is something generous and obvious at the same time. People who write about their financial status know what others may have faced in a similar situation. For instance, if anytime you get an opportunity to go thought the book of The Total Money Makeover by Dave Ramsey, just flip over! You will find some numbers on the internet saying that it has helped around millions of people in their financial aspects, but contrastingly, it was written for people who made exquisitely poor financial decisions.

Is that really needed?

Don’t you think that financial problems are more acute these days? It is true that rising prices, less job security, and irresponsible use of credit cards have added to our problems, but aren’t we more responsible for our suffering? Most of us lack basic knowledge of finance management. A part of our financial hardship is caused because we are not well-conversant on basic money management skills.

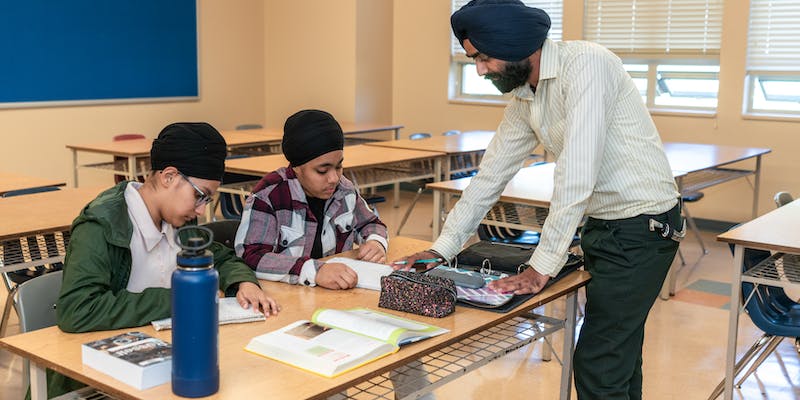

Managing money is no less important than making it because every penny saved adds to your real income. It is always better to initiate the learning process since early childhood. If they are taught finance management right from when they are in school days, it will be of good help for them in the real world. Personal finance articles for school students can really change their outlook towards managing finance.

What can be the first step taken by anyone to avoid the financial mess in the initial career days?

Indeed, getting started with financial knowledge and the skills for saving money can be started as early as you went to your high school. Managing money can be a significant step for getting started with the actual financial aspects that rule the current markets globally.

Setting the students to successful financial management is something that can be effective in the long run. Moreover, if you have kids of lesser age, you can introduce the money aspects for saving for what they want and realizing the value of your hard-earned money. But on the other hand, during high school, when children tend to think like an adult, they can get their needs met with good financial management. In this period of time, most of the students manage and save money, may be for their education or something big they want. Some also go in for various paid internship for a great career start. It would not be wrong to say that some of them may be on their edges to make big decisions for opting out of school and start a startup kind of thing with their own savings! Scroll down to know the various aspects of getting your high school children to know before leaving the nest you created!

-

Instilling the idea of saving money at an early age!

You are never too young to save. Well, if you are a high school student, you must be reading this article! Indeed, managing and getting off your financial curiosity for meeting the correct value of money and saving them for bigger goals can be an excellent idea. As a parent, you can give them small allowances and let them settle the best deal for it. For instance, if you opt for giving $2 to your child, watch their selections and reactions for the amount. Understanding the importance of opportunity cost and letting your purchase rest on a profitable deal can be something essential in the long run. Apart from that, how about setting a mid-term savings concept in your high school child?

Indeed, that can be fantastic! While in high school, they can save big for their prom dress and other video games if gaming is something that fascinates your child. Let your children opt for long-term savings if they are enrolling for a paid internship. In that way, you will actually make them participate in their school fee and other necessary belongings cost. On the other hand, this will make your child feel the nerves for being in the game!

-

Ever thought of compound interest!

Get your teenager to follow your explanations of compound interest loans and savings. This can be an excellent idea for letting your child understand the importance of a penny as it builds a hefty amount in due course if time. For instance, you can also let them start with an amount of $1000 and add an amount of $25 per month. Keep your saving years as large as 40, help the children know the consequences of savings for a financial future. In that way, you can get your high school child save a hefty amount as large as $100,000 before he opts for retirement!

Well, that was amazingly effective. Always remember that you do not have to go in debt to pay your school or school fees. Telling your child about the various investment options can be equally functional. More often, it is seen that high school students opt for a car investment! Well, giving them a reality check for selecting their investments wisely can secure a better financial future for them in the long run.

Let us have a quick glance over the most popular programs to educate the school students in this regard.

Financial EduNation Campaign, an initiative by NFEC offers free personal finance programs to educate young adults regarding financial matters. Plenty of resources are available in the form of articles, videos and other sorts of guides on different finance related topics. These sources offer helpful guidance and practical advice apart from helping the school-goers to understand the fundamentals of personal finance.

These resources will help not only the students but also be equally helpful for the teachers. These guides are completely real-life oriented, so one can apply learning in their practical life. Students usually manage with what they get from parents or allowance or a little sum they earn. If they are inculcated with the right skill of money handling earlier in their life, it will benefit them throughout their lifetime.

The students are almost flooded with offers from the credit card companies when they take admission to colleges. However, with little or no financial literacy, they might not be able to manage their credit cards. It is most important for them to be in knowledge of how to handle the cards. They should know the importance of paying bills on time and having a perfect credit score. Their responsibility in managing them will reflect in their credit record.

It is high time for the schools to integrate a practical financial education course. It will help the students develop financial acumen and achieve excellence at managing finance before they enter in the professional field. Schools need to play a positive role as kids are less likely to learn from the parents because they don’t have proper education to help their children with financial guidance.

Personal finance articles for the students offer multiple benefits. Firstly, they teach the students how to save on expenses in different categories without compromising with quality of life and secondly, they help them build up wealth. After college studies, when they decide to move in life, these students will never be at the mercy of credit card companies. They can make an educated decision while taking out a loan or dealing with a credit card company. Gen Y can be more financially strong if necessary resources are made available to them.